The Storm Didn’t Make Headlines — But It Changed Everything

It wasn’t a named storm.

No dramatic footage. No breaking news banners.

Just a long night of wind, sideways rain, and the sound of trees bending farther than they should.

By morning, the neighborhood looked fine. No flooding. No shattered windows. But a week later, the insurance letters started arriving. That’s when homeowners realized something important:

Living on the coast doesn’t just change your view. It changes your insurance reality.

If you’re buying a home in Southport, St. James Plantation, or anywhere in Brunswick County, coastal insurance isn’t an afterthought. It’s part of the purchase decision — whether buyers realize it or not.

This is the story most people don’t hear until after they move in.

1. Why Coastal Insurance Works Differently Here

Inland buyers are often surprised by how insurance is structured along the North Carolina coast.

Here, coverage is rarely bundled into a single policy. Instead, it’s layered — each layer protecting against a different risk.

Most coastal homeowners carry:

-

A standard homeowners policy

-

A separate wind & hail policy

-

Flood insurance (sometimes required, sometimes optional but wise)

Each piece behaves differently during storms, claims, and renewals.

2. Wind & Hail: The Coverage You Feel First

When coastal storms roll through, wind does the most immediate damage:

-

Roof shingles lift

-

Siding loosens

-

Trees fall

-

Power lines come down

In many Brunswick County areas, wind & hail coverage is not included in the standard homeowners policy and must be purchased separately.

This policy:

-

Often carries a percentage-based deductible, not a flat dollar amount

-

Can trigger higher out-of-pocket costs after storms

-

Is required by many lenders for coastal properties

Buyers often focus on the monthly premium and overlook the deductible — until they need it.

3. Flood Insurance: Even When the Water Doesn’t Rise

Here’s a common misconception:

“If the house didn’t flood, flood insurance doesn’t matter.”

In reality:

-

Flood insurance is tied to location and elevation, not recent events

-

Homes outside high-risk zones can still be required to carry it

-

Storm surge, drainage backup, and tidal flooding don’t always follow maps

Many homeowners who skipped flood insurance regretted it after modest storms caused unexpected water intrusion — not catastrophic floods, just enough damage to be expensive.

4. Deductibles: The Silent Line in the Policy

Coastal insurance deductibles behave differently.

Instead of $1,000 or $2,500 deductibles, wind policies often use:

-

1%–5% of the home’s insured value

On a $600,000 home, that can mean:

-

$6,000 to $30,000 out of pocket before coverage applies

This is why understanding the policy before closing matters far more than the premium alone.

5. How the House Itself Changes the Equation

Not all coastal homes insure the same — even on the same street.

Insurance pricing is influenced by:

-

Roof age and material

-

Elevation certificate

-

Crawl space condition

-

Impact-rated windows or shutters

-

Distance from open water

-

Construction year and building codes

Two similar-looking homes can carry very different insurance profiles.

6. Why Buyers Should Review Insurance Before Making an Offer

In Brunswick County, experienced buyers and agents treat insurance like inspections — part of due diligence, not an afterthought.

Smart buyers:

-

Request insurance estimates early

-

Review deductible structures

-

Confirm flood zone status

-

Ask about past claims

-

Understand renewal risks

Waiting until closing can turn a great deal into a financial surprise.

7. How Storms Change the Market — Quietly

After major storm seasons:

-

Insurance premiums adjust

-

Deductibles increase

-

Coverage availability tightens

-

Buyer expectations shift

This affects:

-

Affordability

-

Buyer demand

-

Resale timing

-

Negotiation leverage

Insurance doesn’t just protect the home — it subtly shapes the real estate market itself.

Coastal Living Is Still Worth It — When You’re Prepared

Storms are part of coastal life. But surprises don’t have to be.

Understanding coastal insurance doesn’t make you fearful — it makes you confident. The buyers who thrive here aren’t the ones who ignore risk. They’re the ones who understand it and plan accordingly.

With the right guidance, coastal living remains everything people hope it will be.

More resources

-

Why Price Reductions Are NormalWhy Price Reductions in St. James Plantation Are a Normal Part of the Market Cycle

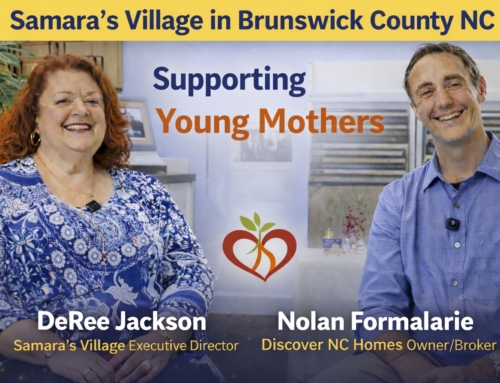

Work With Discover NC Homes — Local Knowledge Makes the Difference

At Discover NC Homes, we guide buyers and sellers through the realities of coastal ownership every day — including insurance considerations that most people don’t think about until it’s too late.

Whether you’re buying in Southport, St. James Plantation, or elsewhere in Brunswick County, our team helps you understand the full picture before you make a decision.

📞 Call us at (910) 363-4387

🌐 Visit www.DiscoverNCHomes.com

Let’s make sure your coastal home is protected — and your plans stay on solid ground.

About Nolan Formalarie

Nolan Formalarie has been in the North Carolina Real Estate Industry for over 8 years and enjoys every minute of it. He is involved in every aspect of the industry including selling and purchasing residential property, home watch services, property management, association management and construction.